Miniature, Micro and Chip-size Spectrometers: Technologies, Market Trends and Customers' Needs (2020)

Spectroscopy will become a part of people's daily life

Find the report flyer in the Attachments

Objectives of the report

- Provide a definition to discriminate between miniature, micro and chip-size spectrometers.

- Provide market data and forecasts for compact spectrometers.

- Describe and segment various strategies for miniaturization of spectrometers at commercial and research level.

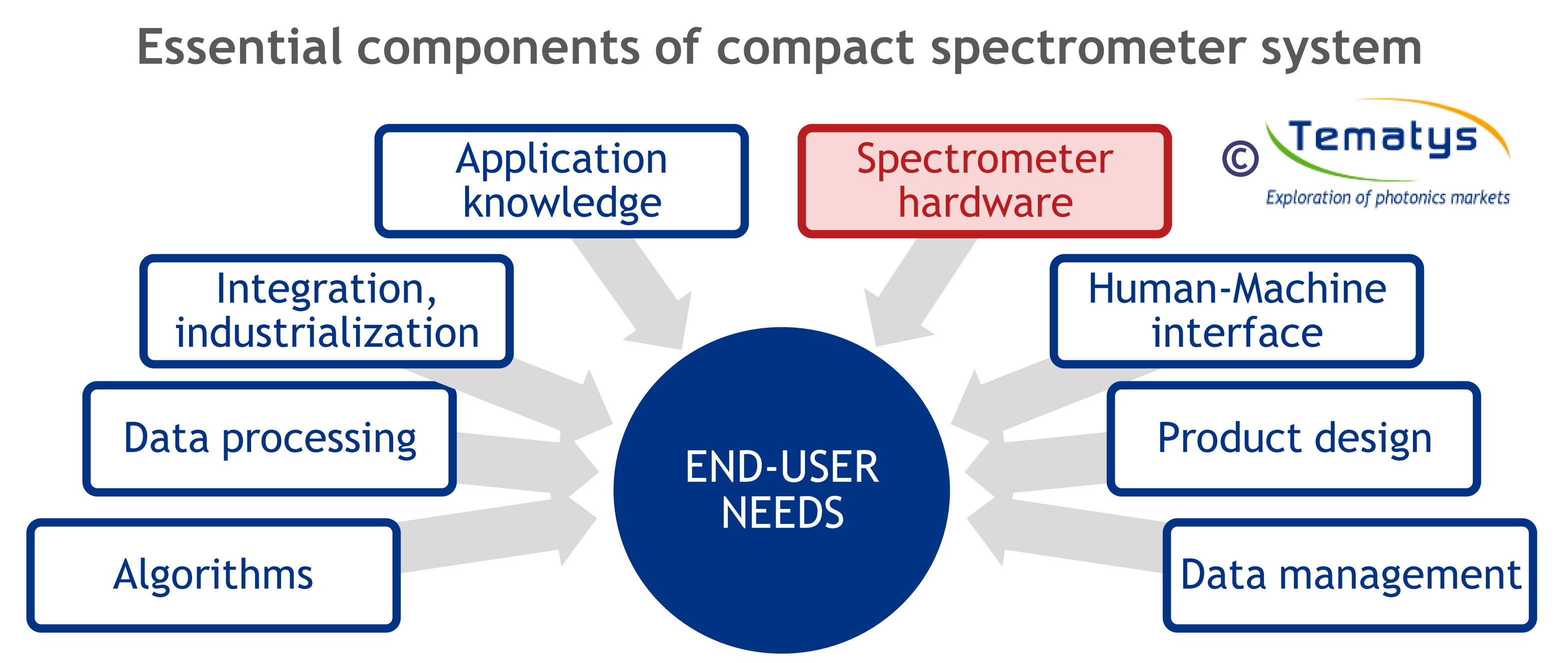

- Highlight the importance of data analysis and solution oriented approach in the development of compact spectrometers.

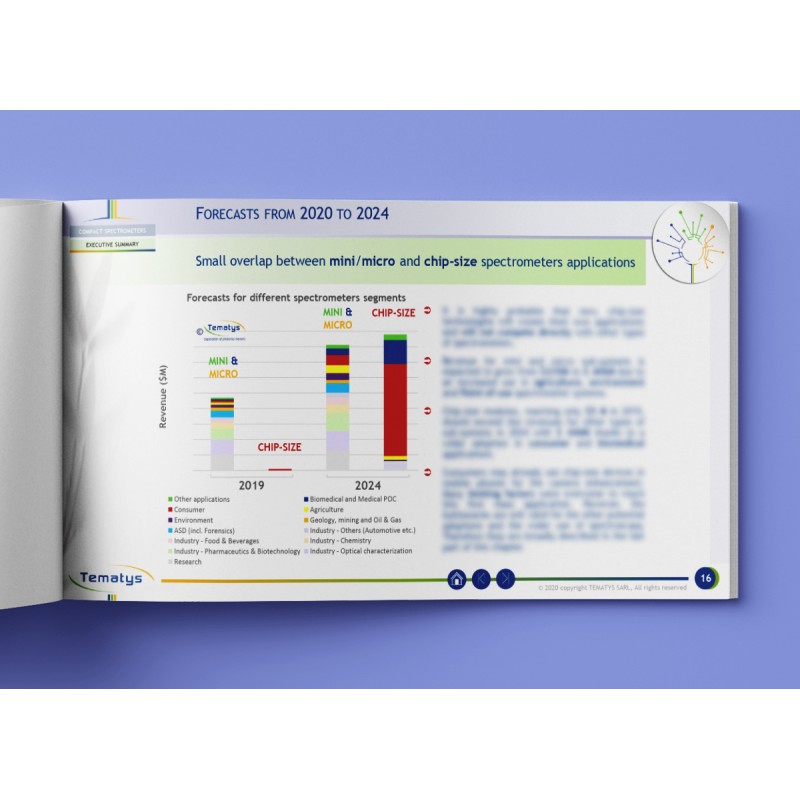

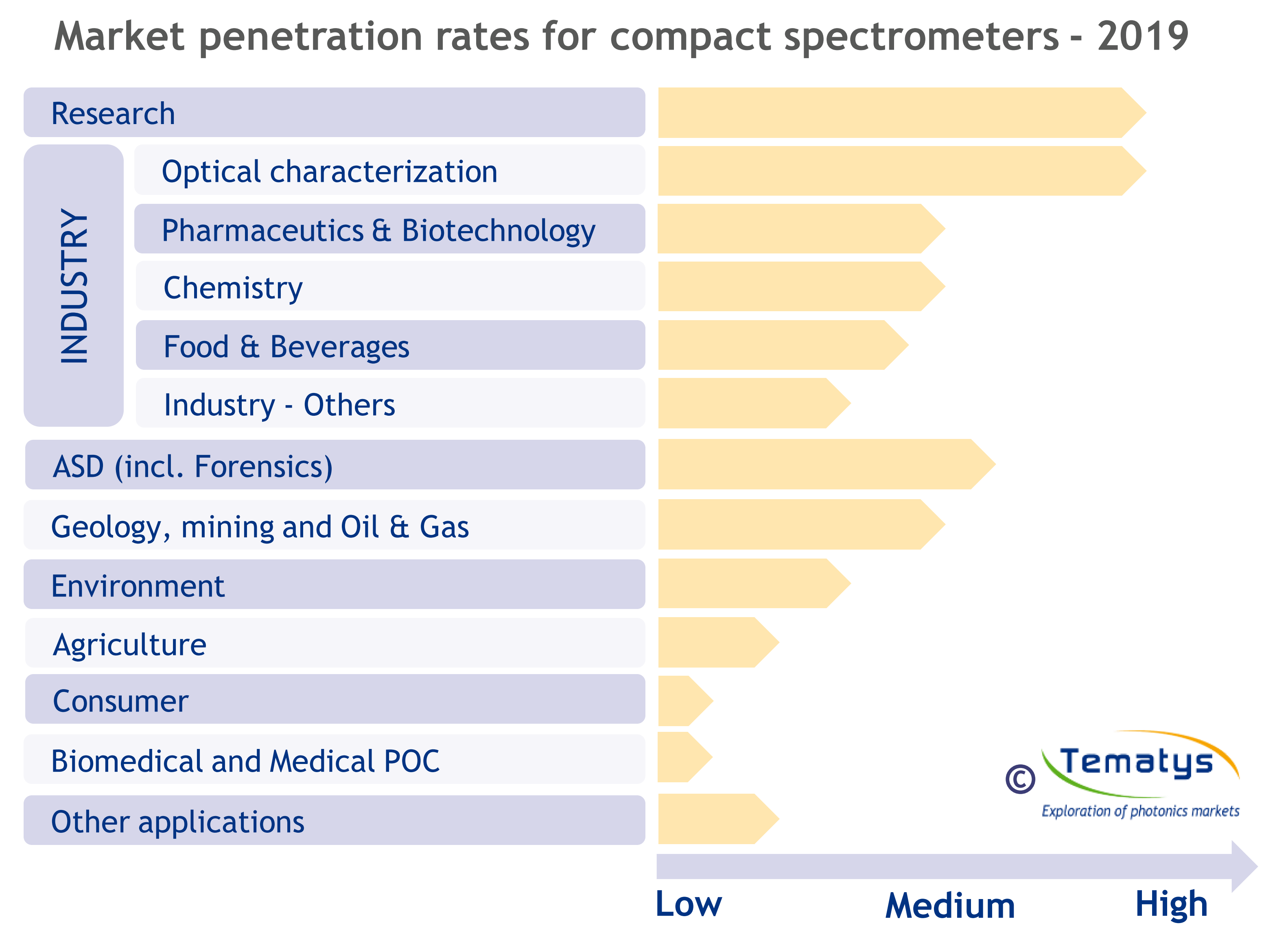

- Identify the most promising applications for miniature, micro and chip-size spectrometers.

- Understand end-users requirements to meet and challenges to overcome for a wider adoption of compact spectrometers.

Report outline

- Title: Miniature, Micro and Chip-size Spectrometers: Technologies, Markets Trends and Customers Needs

- 200+ slides (PDF)

- € 4 990 – Multi users license

Key Features of the report

- Definition of miniature, micro and chip-size spectrometers

- Market revenue breakdown between classical and miniaturized spectrometers

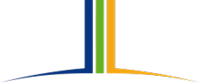

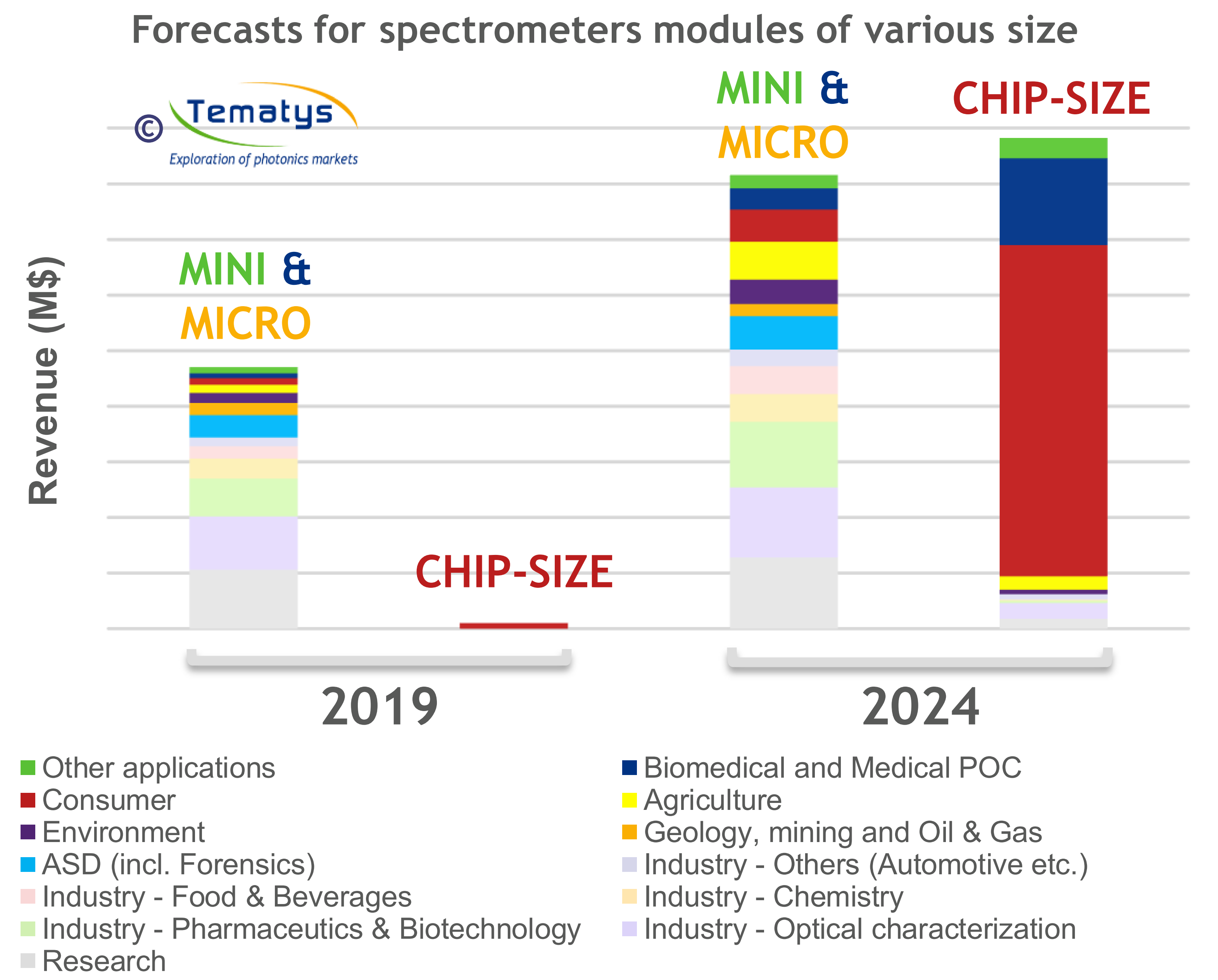

- Unique compact spectrometers market forecast by applications 2020-2024

- Main OEM spectrometers manufacturers analysis

- Presentation of dominant market trends

- Description of strategies for spectrometers miniaturization

- Review of most promising applications

Spectroscopy will become a part of people’s daily life

A new dynamic for spectral analysis is coming: while miniature and micro spectrometers achieve steady growth and find well established position on the market, the disruptive chip-size technologies come up and elevate the role of spectroscopy to an entirely new level. Now spectrometers can be available to everyone.

In the last few years optical spectroscopy became more popular due to the increasing need of in-line, on-field and Point-of-use measurements. The interest was confirmed by the high growth of Compact Spectrometers Systems market, which went from $ 655M to $ 922M in just three years (between 2016 and 2019). Emerging chip-size spectrometers are going to fuel this growth even more.

New type spectrometers can be as small as semiconductor wafers. Their ultra compact size (<1 cm3) allows to integrate spectral analyzers with smartphones and wearable devices. The fastest growing applications will be therefore biomedical and consumer. The use of chip-size spectral sensors should reach >300M of pcs per year in 2024, with CAGR up to 111% (2020-2024) for some applications.

The report provides a comprehensive view on the process of spectroscopy popularization. It describes the Compact Spectrometers market in detail, including breakdown into applications and segments. It also reaffirms and extends our predictions from the previous, 2016 TEMATYS report.

Disruptive chip-size technologies play the dominant role in the growth of compact spectroscopy

The first aim of development of compact spectrometers was to bring the lab measurements to the field or in the process line. By maintaining required performance level it was accomplished in many industrial applications: optical characterization, pharmaceutics and biotechnology, chemistry etc. It was at the time when miniature spectrometers emerged (size <10 000 cm3).

Few years later the same spectrometers opened also new applications where spectroscopy had not been used before: precision farming, recycling, process control, etc. The range of potential applications became vast. The market started to be split into a wide variety of niche adoptions, each having own requirements (performance, costs, design, operating conditions, …). This implied the development of products specifically to each segment.

At the same time micro spectrometers were first presented (size between 10 000 cm3 and 100 cm3), offering similar performance to miniature devices but in a handheld, portable design. They enabled to launch new systems for professional users.

Now it is still research and industrial optical characterization that possess the biggest shares within the compact spectrometer market. However, the better knowledge of end-users needs results in improving medium series applications (agriculture, environment) and also in developing further solutions for professionals (hair analyzers, textile identifiers, cannabis testers etc.).

A turning point for the market is coming. It is the arrival of global leaders both in the role of manufacturers (ams, Osram, VIAVI) and end-users (Huawei, Samsung, Bosch, Henkel). Big players will drive the market towards consumer and biomedical applications (images enhancement, personal monitoring etc.). This is possible due to the emergence of chip-size spectral sensors (<1 cm3).

The question is to what extent this technology will be exploited. The report answers this question by providing market forecast from 2020 2024.

The study also provides a detailed analysis of most promising applications and describe the end-users needs for widespread adoption of compact spectrometers.

Are the acquisitions going to consolidate the market?

Consolidation is now more evident trend on the spectrometers market.

Due to the transactions made by Nynomic Group (acquisitions of Avantes and tec5 before 2016, Spectral Engines in 2018), Metrohm (B&W Tek in 2018, Snowy Range Instrument in 2016, earlier IPS) and Halma (owner of Ocean Insight since 2004) only this three companies accounted for 1/3 of the total market revenue (2019).

The gap between the biggest entities and small competitors is widening, it is also harder to enter the market. Older companies are trusted, can provide many references and offer mature products.

It is still an open question who is going to catch the value on the current compact spectrometer sub-systems market out of the main players. This report analyzes key elements for a successful adoption of a spectroscopy product.

Innovative solutions

To reach new applications, technological breakthrough is necessary. That is why miniaturization of spectrometers exploits new designs and novel ideas.

Recent progress in the development of compact spectrometers follow this path and takes an advantage of micro-technologies such as MEMS and MOEMS. This reduces the cost and offers large production capabilities while maintaining high performance.

In case of new, chip-size spectrometers, the dominant technologies are: ultra-small gratings, multispectral filters, plasmonic filters, photonic crystals and organic semiconductors.

This study consists a detailed description of all key technologies of the compact spectrometers market with examples of manufacturers. Advantages and trade-offs for each technology have been also discussed.

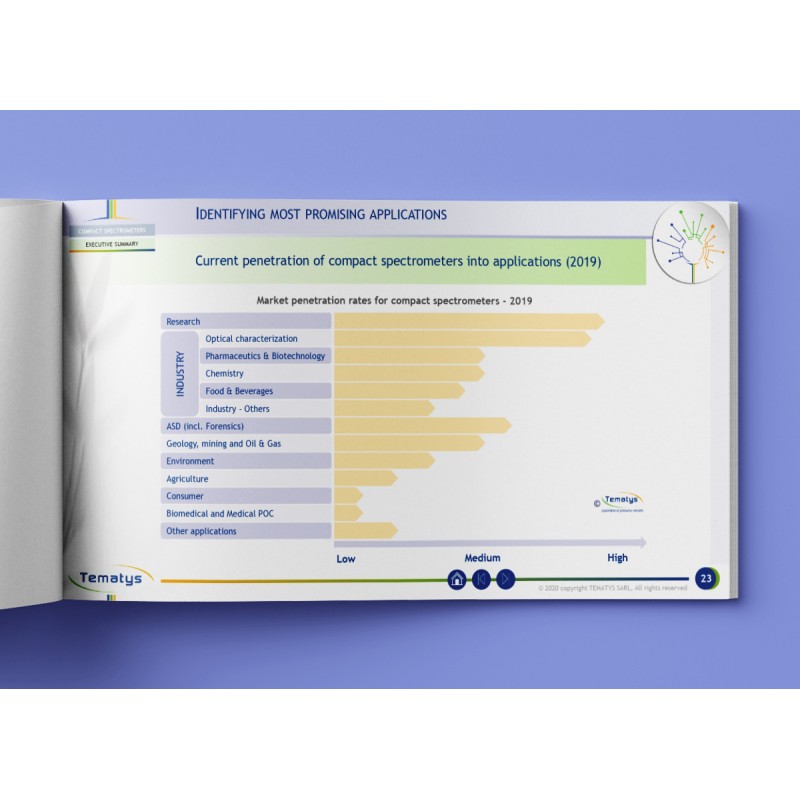

Key importance of modern algorithms

Data analysis is becoming crucial for developing new applications in spectral analysis, especially those based on ultra small spectrometers.

Global IT environment helps in the progress - development of Cloud Solutions, Big Data, Machine Learning and Artificial Intelligence is very extensive all around the world. There is a massive funding for Machine Learning companies ($ 16.5B in 2019 globally, driven by 695 deals).

Modern algorithms become the key element of the spectroscopic system - even if there is a lot of stray light in the spectrometer one can correct it with proper data processing. Algorithms allow to reduce the cost of extracting useful information from the spectra. This helps to bring spectroscopy out of the lab.

The report helps to understand the role of modern algorithms in compact spectroscopy.

Compact spectrometers manufacturers mentioned in the report

Admesy, ALS, ams, APE Angewandte Physik und Elektronik, Arcoptix, Attonics Systems, Avantes, B&W Tek, BaySpec, Broadcom, Brolight Technology, Carl Zeiss Spectroscopy, Chang-Yu Technology, Chromation, CNI Laser, Consumer Physics, Control Development, Enhanced Spectrometry, EVERUPING Optoelectronic, Gamma Scientific, getAMO, GOC, GoyaLab, Hamamatsu, Headwall Photonics, HiperScan, Holmarc Opto-Mechatronics, HORIBA Scientific, Ibsen Photonics, Ideaoptics, InfraTEC, Insion, Instrument Systems, IS Instruments, JETI Technische Instrumente, LightMachinery, LTB Lasertechnik, LuxFlux, Miriad Technologies, Nano Optic Devices, nanoLambda, NLIR, Ocean Insight, OPTO4L, OptoSky Photonics, Oto Photonics, Oxford Instruments – Andor Technology, Pixelteq, PYREOS, Radiantis, Rainbow Light Technology, Resonanance Optical Solutions, SarSpec, Seeman Technology, Senorics, Si-Ware, Solar Laser Systems, Spectral Engines, Spectricity, Spectral Evolution, Spectral Products, Spectrolight, StellarNet, tec5, Testright Nanosystems, Teledyne Princeton Instruments, Texas Instruments, Thorlabs, UV-Design Edgar Hohn, VIAVI Solutions, Wasatch Photonics and >60 other companies

Table of contents

Executive Summary

- Study goals and objectives

- Information sources and methodology

- Scope of the report

- Glossary

- Definitions

- List of companies mentioned in the report

- From Photonics to the function

- Distinction between different spectrometers size

- Spectrometers vs. spectral sensors

- Value chain

- Market data

- Forecasts from 2020 to 2024

- Going from hardware to solutions

- Spectroscopy will become a part of people’s daily life

- Technological landscape

- Dispersive spectroscopy

- Fourier Transform spectroscopy

- Fabry-Pérot Interferometer-based spectroscopy

- Emerging miniaturization Strategies:

Using Photonics Integrated Circuits, Other approach

- Identifying most promising applications

- Small series market – industry

- Medium size market – agriculture, environment and professional use

- Large market adoptions – consumer and medical applications

6. Appendices